We’ve known Mitch Ginsberg and Eric Little with CommLoan for four years. They are quality and dedicated individuals with a great team and our agents have used CommLoan to help their clients. CommLoan collects the essential loan criteria and sends this to many possible lenders. This often creates a competition between the lenders resulting in the best loan possible for the borrower. We’ve also used CommLoan to find lenders for challenging properties – like a broken condo regime in a secondary market. On Thursday March 11, 2021, CommLoan provided a video presentation of their company to West USA’s Commercial Division. They are a great resource for purchasing metro phoenix apartments and if you’re an owner seeking to refinance apartments.

Connecting Borrowers With The Right Lender and Loan

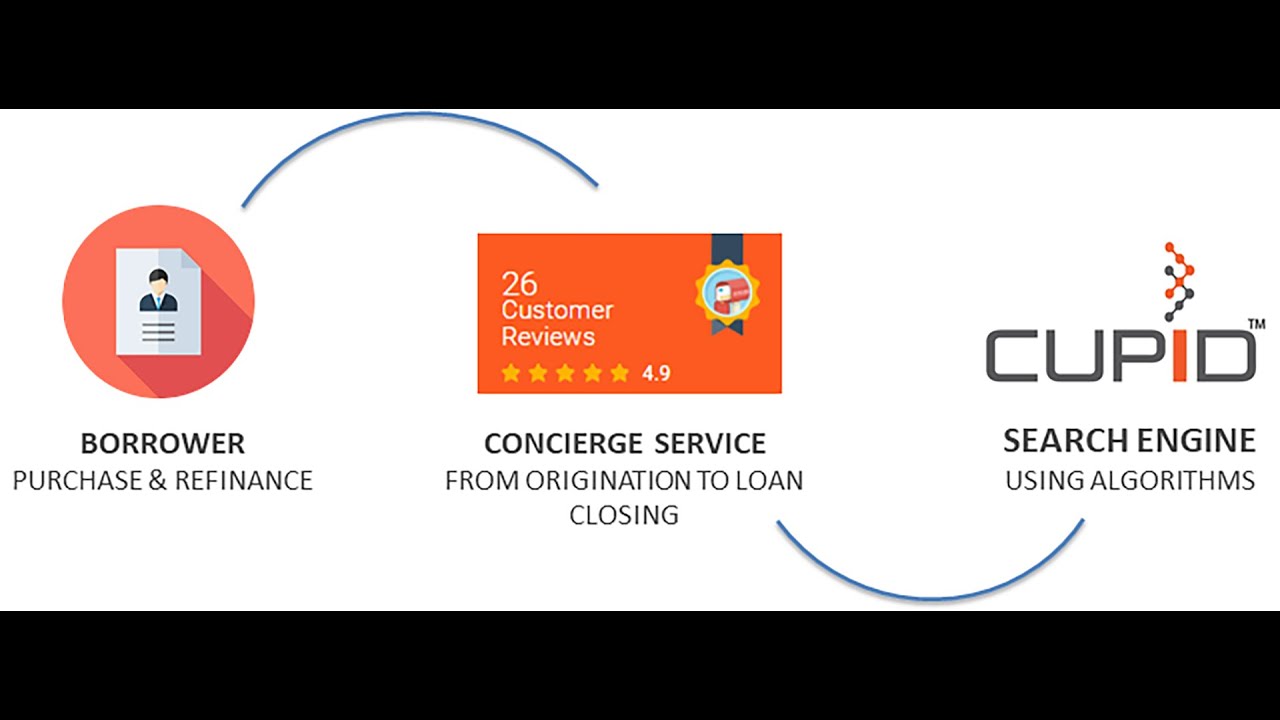

CommLoan is a technology company based in Scottsdale, Arizona. With access to hundreds of lenders and thousands of loan programs, CommLoan connects borrowers with the right lender and loan within minutes using a single point of contact.

Their process is simple.

- Enter Your Desired Loan Type and Terms

- A loan consultant calls you to get specifics

- Within minutes, get a prequalification certificate outlining the terms of your loan options

Hear from CEO Mitch Ginsgerg how CommLoan uses technology to disrupt the commercial real estate lending space

Presentation Slides

Video Transcript

47

00:04:03.030 –> 00:04:11.340

Mitchell Ginsberg: So just to give you guys a real quick overview about CommLoan we’re a commercial.

48

00:04:12.540 –> 00:04:29.040

Mitchell Ginsberg: Real Estate lending platform we’ve been around for about six years now started beta testing the platform in Arizona and California took about a year and a half to develop the technology we have a full time development team in India, we have an office outside daily.

49

00:04:30.960 –> 00:04:33.090

Mitchell Ginsberg: Which we’ve had for the six years or so.

50

00:04:34.140 –> 00:04:47.430

Mitchell Ginsberg: And we’re just probably in the last several months started scaling nationally we’re in oh my God probably about 10 States now we’re in Arizona California Colorado utah.

51

00:04:49.110 –> 00:04:51.660

Mitchell Ginsberg: Texas Florida Georgia.

52

00:04:53.130 –> 00:04:59.400

Mitchell Ginsberg: Washington state and probably by the beginning of next month, we should be New York and New Jersey.

53

00:05:00.420 –> 00:05:09.330

Mitchell Ginsberg: We cover all property types, with the exception, at the moment of hotels has to tell it says, because nobody’s lending on hospitality because of the pandemic.

54

00:05:10.680 –> 00:05:12.570

Mitchell Ginsberg: And we don’t do land and.

55

00:05:13.650 –> 00:05:15.780

Mitchell Ginsberg: religious institutions, excuse me.

56

00:05:16.800 –> 00:05:20.880

Mitchell Ginsberg: Oh God just had a nice covering on that went away so.

57

00:05:22.080 –> 00:05:28.380

Mitchell Ginsberg: So yeah we pretty much will do everything else you know the four main food groups, which is a retail industrial office and.

58

00:05:29.340 –> 00:05:38.880

Mitchell Ginsberg: Return industrial office in multifamily but then we’ll do you know single tenant we will do triple net lease properties will do rehab.

59

00:05:39.720 –> 00:05:50.490

Mitchell Ginsberg: We don’t do ground up construction, because once again that’s too many moving parts, but the but will do any kind of rehab with it’s a major rehab or a library as.

60

00:05:52.050 –> 00:05:55.230

Mitchell Ginsberg: Our minimum loan size that we do is a million dollars.

61

00:05:56.910 –> 00:06:03.030

Mitchell Ginsberg: We do a lot of SBA for owner occupied we’ve got phenomenal SBA products.

62

00:06:04.410 –> 00:06:18.660

Mitchell Ginsberg: So that’s I mean we’ve we’ve very aggressive on you know both the fog before and the seven day, so I think that gives a real brief overview and and what i’m going to touch on and i’m going to start sharing my screen, if I can.

63

00:06:22.950 –> 00:06:24.090

Mitchell Ginsberg: Can you make money doing that.

64

00:06:24.180 –> 00:06:28.230

Eric Little: yeah Mitch, I see it, I just want to add to what something you said.

65

00:06:29.550 –> 00:06:38.370

Eric Little: We also do single family home portfolios, so that might be something you guys run across from time to time, we could restructure the debt or purchase money.

66

00:06:38.880 –> 00:06:53.400

Eric Little: And I think on a rare cases basis if you guys had something less than a million that was still palatable it, you know, it was a deal that had legs, we had a good sponsor and a good property, we would consider.

67

00:06:54.720 –> 00:07:07.710

Eric Little: You know stuff that’s in that you know 500,000 a million dollar range as far as the loan proceeds loan amount would have to be you know at least 500,000 and that’s just on a case by case exception based.

68

00:07:08.370 –> 00:07:09.420

Mitchell Ginsberg: Alright, thanks Eric.

69

00:07:09.780 –> 00:07:24.270

Mitchell Ginsberg: So what i’m going to touch on really briefly before we get into the details, is really how technology is changing our world and we just demonstrating how COM loan has a technology platform which is really going to change the way.

70

00:07:25.290 –> 00:07:29.640

Mitchell Ginsberg: Commercial real estate is financed so going back a little bit in history.

71

00:07:30.750 –> 00:07:35.310

Mitchell Ginsberg: and sisters ancestors probably about 200,000 years ago were hunters and gatherers.

72

00:07:36.930 –> 00:07:41.400

Mitchell Ginsberg: And, and there was you know for 200,000 years they did it.

73

00:07:43.140 –> 00:07:49.620

Mitchell Ginsberg: And then, then for about 1200 years people sort of figured out to settle down and they can stay in one place.

74

00:07:50.340 –> 00:08:04.020

Mitchell Ginsberg: And you know raise crops and livestock and not have to you know walk around from place to place so your agricultural era will last for about 1200 years 12,000 years sorry.

75

00:08:04.620 –> 00:08:18.630

Mitchell Ginsberg: So you went from 200,000 to 12,000 and then with the advent of the locomotive and the steam powered engine you had your industrial area which lasted about 250 years.

76

00:08:22.560 –> 00:08:33.060

Mitchell Ginsberg: You then have 68 years ago the silicon chip was developed which really transformed processing power and processing capabilities.

77

00:08:33.750 –> 00:08:42.810

Mitchell Ginsberg: And around 68 years ago, believe it or not, it seems like it’s been around a lot longer the Internet was was developed and.

78

00:08:43.740 –> 00:08:52.980

Mitchell Ginsberg: And pretty shortly thereafter the advent of online platform, so the whole point of this exercise is to show how time is compressing.

79

00:08:53.610 –> 00:09:01.140

Mitchell Ginsberg: And how these the the the advancements of mankind is just sort of leaping ahead in such a short timeframe.

80

00:09:01.620 –> 00:09:21.990

Mitchell Ginsberg: And it’s all a result of technology of of this huge advancement in technology, which really was spearheaded by the development of the silicon chip, so you went from 200,000 220,000 to turn her 52 now you know just over a half a decade office century.

81

00:09:24.390 –> 00:09:24.900

Mitchell Ginsberg: That.

82

00:09:26.010 –> 00:09:30.300

Mitchell Ginsberg: You know you you’ve got these huge advancements taking place.

83

00:09:31.650 –> 00:09:35.190

Mitchell Ginsberg: You know if you’re just took nap and looked at our lives today.

84

00:09:36.600 –> 00:09:44.160

Mitchell Ginsberg: household so obviously Amazon being the granddaddy on the retail side through uber.

85

00:09:45.330 –> 00:09:50.010

Mitchell Ginsberg: Through netflix and priceline and airbnb and match.com.

86

00:09:51.270 –> 00:09:58.920

Mitchell Ginsberg: You know you it’s just really the use of technology and search engines to synthesize.

87

00:09:59.490 –> 00:10:09.240

Mitchell Ginsberg: A huge amount of data in a very short space of time and give the user, the ability of sorting out and saying, these are the criteria that i’m looking for.

88

00:10:09.570 –> 00:10:18.810

Mitchell Ginsberg: find me the base, based on what i’m looking for and it applies to personal life there’s all these dating sites in a match and II harmony, etc, etc.

89

00:10:19.890 –> 00:10:28.860

Mitchell Ginsberg: Obviously Amazon has redefined the retail space, not only from access to information, but using technology to totally transform.

90

00:10:29.370 –> 00:10:41.790

Mitchell Ginsberg: The whole user experience from the delivery times to tracking of parcels etc, and then, if I would have told you, you know just several years ago, that you would have gone into total strangers car.

91

00:10:42.300 –> 00:10:59.370

Mitchell Ginsberg: and have them drive you wherever you want to go, you would have thought I was like totally crazy, but you know uber lyft it’s just commonplace that people do it and it’s just being enabled by by technology priceline orbits travelocity etc for.

92

00:11:00.960 –> 00:11:07.410

Mitchell Ginsberg: You know, for the travel industry netflix with the you know broadband and the ability to stream data.

93

00:11:08.490 –> 00:11:12.060

Mitchell Ginsberg: you’ve obviously got blockbuster that’s gone out of business and.

94

00:11:12.990 –> 00:11:28.710

Mitchell Ginsberg: You know you it’s just really redefined, entertainment and then, once again airbnb way if I would have told you 10 years ago that you’re comfortably go stay in a total strangers home, you probably would have thought I was NUTS as well and airbnb has enabled that.

95

00:11:30.120 –> 00:11:38.820

Mitchell Ginsberg: You know you look at a local story pet smart, which is obviously is one of the big retailers that are headquartered out of.

96

00:11:40.320 –> 00:11:47.580

Mitchell Ginsberg: Out of Arizona, you know they have an excess of 1500 stores and and they they are doing very well.

97

00:11:48.420 –> 00:11:58.980

Mitchell Ginsberg: However, they saw the need to spend you know in excess of a billion dollars acquiring to ease because they saw the power of online retailing.

98

00:11:59.400 –> 00:12:08.040

Mitchell Ginsberg: And, and they saw online retailing as an enormous threat to their business, so instead of trying to beat them they joined them so so clearly.

99

00:12:08.460 –> 00:12:20.280

Mitchell Ginsberg: Across the board technology is redefining the way we look at our lives, so now looking at commercial real estate who the big players in commercial real estate.

100

00:12:20.700 –> 00:12:28.110

Mitchell Ginsberg: You obviously have the granddaddy coast or which really controls, a huge amount of the data.

101

00:12:28.830 –> 00:12:42.180

Mitchell Ginsberg: coasts obviously owns loop net their own I believe apartments.com and a whole bunch of other subsidiaries, but really dominating the commercial landscape, as far as as far as data information.

102

00:12:42.930 –> 00:13:04.140

Mitchell Ginsberg: using technology and then you have all these other online platforms popping up you know you have 10 X, which was formerly auction COM, you have Craig see real next, and obviously we’re the probably only online commercial real estate lending platform that empowers the borrower and.

103

00:13:05.430 –> 00:13:15.300

Mitchell Ginsberg: turns the golden rule on its head and for those of you that don’t know the golden rule the golden rule is he has the gold makes the rules right.

104

00:13:16.470 –> 00:13:22.980

Mitchell Ginsberg: And up till now that’s been the case, because the banks have the gold they’ve got the money and up till now they’ve made the rules and it’s been a case of.

105

00:13:23.640 –> 00:13:38.970

Mitchell Ginsberg: Let me figure out how to fit this borrower into my guidelines what we doing and it’s quite funny we have a poster of the golden rule in office, and we have it framed upside down because we want to turn that golden rule onto its head.

106

00:13:40.260 –> 00:13:46.800

Mitchell Ginsberg: And we want to empower the borrower many is nothing more than a commodities, so the the the lenders.

107

00:13:47.490 –> 00:13:54.300

Mitchell Ginsberg: shouldn’t be the ones calling the shots the borrower is should be the one calling the shots for borrower is the one that should be treating the lender.

108

00:13:54.840 –> 00:14:06.060

Mitchell Ginsberg: And and choosing the variable that best set the bar is needs opposed to the lender dictating Well, this is what you how you need to do it, because this is what we can do.

109

00:14:08.340 –> 00:14:17.310

Mitchell Ginsberg: So this look at the commercial real estate lending marketplace it’s very complex it’s very fragmented.

110

00:14:17.910 –> 00:14:23.730

Mitchell Ginsberg: you’ve got all these different lender types, you know you know residential For those of you that do residential.

111

00:14:24.630 –> 00:14:30.120

Mitchell Ginsberg: lending is pretty simple you know you have Fannie Mae and Freddie Mac that dominate the market.

112

00:14:30.960 –> 00:14:36.300

Mitchell Ginsberg: You can get a city of fakes you can get a 15 year fixed you can maybe get an intermediate adjustable.

113

00:14:36.810 –> 00:14:45.240

Mitchell Ginsberg: The property tops are going to be a single family home anyway, through a duplex through a four plex that’s it, I mean there’s really nothing more so.

114

00:14:45.720 –> 00:14:54.540

Mitchell Ginsberg: very, very simple landscape on the on you know the antithesis of that almost is commercial real estate lending where you have.

115

00:14:55.050 –> 00:15:03.450

Mitchell Ginsberg: So many different types of lenders, ranging from CBS which the commercial mortgage backed security lenders like cantor Fitzgerald Goldman Sachs, etc.

116

00:15:03.930 –> 00:15:13.170

Mitchell Ginsberg: You have Fannie and Freddie on the multifamily side you have banks and not all banks are created equal you got federally chartered bank state chartered banks Community banks.

117

00:15:13.500 –> 00:15:20.460

Mitchell Ginsberg: You got credit unions you got dead funds your private money lenders you got insurance companies, every one of these have different.

118

00:15:20.910 –> 00:15:26.820

Mitchell Ginsberg: underwriting guidelines that all have different preferences, as far as property types program types.

119

00:15:27.510 –> 00:15:33.840

Mitchell Ginsberg: So, then, to further complicated you got so many different property types, as we discussed you go to a full main food groups.

120

00:15:34.260 –> 00:15:42.540

Mitchell Ginsberg: Which is industrial office retail multifamily but then you got hospitality you got special use like car washes and.

121

00:15:43.230 –> 00:15:52.350

Mitchell Ginsberg: Self storage is you’ve got hospitality, so you and even within each each category you got subcategories if you look at hospitality.

122

00:15:52.950 –> 00:16:02.640

Mitchell Ginsberg: All hotels on created equal you got full service, you are limited service you got flagged you got enslaved you got internal car door you’re going to external car doors.

123

00:16:03.150 –> 00:16:12.060

Mitchell Ginsberg: And you got a combination of all of those you know where it could be a flag limited servers external car adored could be an ad flag full service.

124

00:16:12.570 –> 00:16:23.520

Mitchell Ginsberg: indoor corridor so and and each land is going to have different requirements as far as what they want to lend on now, if that wasn’t complicated enough now you got all these different loan types.

125

00:16:24.030 –> 00:16:32.340

Mitchell Ginsberg: ranging from mentally adjust symbols on some bridge loans, all the way through to city you’re fully amortized say on a headline.

126

00:16:32.760 –> 00:16:44.640

Mitchell Ginsberg: And everything in between, you know the most typical be in the intermediate adjustable as being the five years, seven years, etc, etc, so needless to say in this environment, the borrower really isn’t well so.

127

00:16:45.930 –> 00:17:07.530

Mitchell Ginsberg: it’s just a very, very tough environment for the borrower so the solution is komlos what he’s come alone, where a online cloud based transformative platform where we give the borrower access to literally 10s of thousands of loan programs.

128

00:17:08.850 –> 00:17:21.300

Mitchell Ginsberg: You know within literally seconds, but we recognize that we dealing with a very, very technical product, you know this isn’t like going online to Amazon and buying a TV where you know your size, you want, you know your prize you want.

129

00:17:21.900 –> 00:17:27.060

Mitchell Ginsberg: there’s a lot of moving parts, so we match the borrower radha front of the season loan expert one of.

130

00:17:27.930 –> 00:17:46.170

Mitchell Ginsberg: The TEAM members on eric’s team, we have a team of long consultants who will then counsel with the borrower and structure the borrower is transaction based on the needs, this is the slides a little bit out of date currently we have probably in excess of 65 star reviews on.

131

00:17:47.370 –> 00:17:57.810

Mitchell Ginsberg: On Google and the way that it works is the the loan consultants will talk with the borrower understands what their needs are keys, the information into our platform.

132

00:17:58.230 –> 00:18:08.370

Mitchell Ginsberg: APP will come all the matches will filter it down to the top six and then the borrower be issued a pre QUAL certificate instantly with the six base options.

133

00:18:08.850 –> 00:18:14.550

Mitchell Ginsberg: If they decide that this is something they want to move forward with we do have them sign an exclusive broker agreement.

134

00:18:15.150 –> 00:18:25.080

Mitchell Ginsberg: The reason we have an exclusive broker agreement is twofold a we’re going to invest a lot of time, energy and money into that borrower processing and packaging, the loan.

135

00:18:26.040 –> 00:18:36.240

Mitchell Ginsberg: So we don’t want to invest, that if we’re going to be working with 10 other brokers and the second reason is, we want to control the transaction and all the lenders we work with.

136

00:18:36.690 –> 00:18:46.050

Mitchell Ginsberg: know that we control the transaction because of that they take our loan seriously, so we able to get the best deal out of every one of these lenders.

137

00:18:46.590 –> 00:18:54.660

Mitchell Ginsberg: Because they know we ultimately are going to be instrumental in working with the borrower to select the best lender.

138

00:18:55.110 –> 00:19:08.550

Mitchell Ginsberg: So it as a result of gets the borrower the best possible terms it’s only a 30 day exclusive and we have a release close that if they don’t like any of the term sheets we provide we released him from the exclusive immediately.

139

00:19:10.500 –> 00:19:16.230

Mitchell Ginsberg: So we have the lender database, the linda’s can update the data is through a portal.

140

00:19:17.490 –> 00:19:27.990

Mitchell Ginsberg: it’s a very, very secure platform so everything is contained within the platform you’re not emailing or faxing data, which is obviously not at all secure.

141

00:19:29.490 –> 00:19:44.790

Mitchell Ginsberg: These are some of the lenders, we have on our platform and it’s actually this is outdated as well, we have probably 984 hundred lenders, including all the big national banks Fannie Freddie bunch of live companies, etc, etc, and then we have.

142

00:19:46.080 –> 00:19:53.490

Mitchell Ginsberg: You know, private label relationships with a lot of the larger commercial real estate companies on a national basis.

143

00:19:54.150 –> 00:20:05.040

Mitchell Ginsberg: So essentially our competition is the traditional way of doing things so you know your your your client could either go the old fashioned way and go from bank to bank themselves and work with a spreadsheet.

144

00:20:06.660 –> 00:20:12.630

Mitchell Ginsberg: And each bank is going to Austin for different requirements and they’re going to go back and forth working with multiple loan officers.

145

00:20:13.440 –> 00:20:35.160

Mitchell Ginsberg: To take weeks and weeks and weeks and it’s a very high effort, the other way is to work with a mortgage broker, who, on a manual basis really can have no more than relationships with 10 possibly 15 lenders also very, very time consuming process also requiring a higher amount of effort.

146

00:20:36.270 –> 00:20:43.020

Mitchell Ginsberg: Or alternatively, they can work with calm loan instantly they’re going to get access to 25,000 plus loan products.

147

00:20:43.740 –> 00:21:05.190

Mitchell Ginsberg: they’ll get a pre QUAL within minutes and very, very low effort so clear, you can see there’s absolutely no comparison, we are fitting in this space with typical mortgage brokers fit, but the same way as priceline and orbits and travelocity in essence fetching the space where.

148

00:21:06.570 –> 00:21:14.880

Mitchell Ginsberg: Your typical travel agent lives and for those of you that all old enough to remember in the old days when we travel.

149

00:21:15.450 –> 00:21:20.730

Mitchell Ginsberg: We would go to a local travel agent on the corner and they would book airline and hotel.

150

00:21:21.210 –> 00:21:29.160

Mitchell Ginsberg: Was that the base probably not but that’s who they had relationships with they could manually only have a limited number of relationships with certain airlines.

151

00:21:29.640 –> 00:21:38.820

Mitchell Ginsberg: and certain hotels, for us, for today and you got priceline and orbits and travelocity etc, etc, and you got access to the to the world’s travel industry.

152

00:21:39.900 –> 00:21:51.210

Mitchell Ginsberg: Where essentially the priceline or orbitz for commercial real estate lending and your old, traditional mortgage broker is really the equivalent to the travel agent in the travel industry.

153

00:21:52.650 –> 00:22:01.230

Mitchell Ginsberg: Anybody got any questions on net guys and I think that sort of gives you a good overview on.

154

00:22:03.750 –> 00:22:07.620

Mitchell Ginsberg: You know, on who come alone is open to any questions.

155

00:22:12.090 –> 00:22:15.480

Mitchell Ginsberg: Either you all fell asleep was it a good job i’m not sure which one.

156

00:22:21.000 –> 00:22:21.480

Mitchell Ginsberg: Sorry.

157

00:22:22.800 –> 00:22:28.470

Jill Falconer: Are we able to post your presentation to our commercial site.

158

00:22:29.280 –> 00:22:32.490

Mitchell Ginsberg: yeah yeah i’ll be happy to share that with you.

159

00:22:33.090 –> 00:22:39.690

Jill Falconer: If you want to send to charge of that would be fine and then i’m also i’m recording this presentation as well.

160

00:22:40.050 –> 00:22:45.570

Tarja Panfil: And you continue right about what the commercial real estate market doing right now.

161

00:22:46.230 –> 00:22:51.330

Mitchell Ginsberg: Absolutely absolutely, so now we get we’re going to continue on the other, stuff I just thought will give you guys.

162

00:22:52.410 –> 00:22:56.220

Mitchell Ginsberg: The opportunity of asking any questions if if you had any.

163

00:22:57.390 –> 00:23:07.770

Mitchell Ginsberg: Alright, so, so the commercial real estate market at the moment, I think, for the most part, is doing extremely well bearing that we’ve just come out of was still in the.

164

00:23:08.070 –> 00:23:11.340

Mitchell Ginsberg: Probably the tail end of a of a major pandemic.

165

00:23:12.720 –> 00:23:17.550

Mitchell Ginsberg: Obviously it’s very regional as well and and and it’s very much.

166

00:23:19.530 –> 00:23:25.560

Mitchell Ginsberg: get to the property type as well, so if you were the owner of a large office tower in Manhattan.

167

00:23:26.700 –> 00:23:38.970

Mitchell Ginsberg: You probably school not doing great because you know anything that required, you know elevators with with a lot of people in those elevators with the social distinct and restrictions.

168

00:23:39.660 –> 00:23:57.840

Mitchell Ginsberg: Generally, those properties were were very hard hit hospitality hotels are just virtually impossible to finance and and I think there’s going to be a lot of on the on the CBS markets are commercial mortgage backed security markets, the default rates are climbing dramatically on hotels.

169

00:23:59.280 –> 00:24:10.530

Mitchell Ginsberg: So, so I think you know that segment is is not doing very well, will it start coming back, I think that will very soon and it’s going to be a lot of pent up demand for it.

170

00:24:12.330 –> 00:24:21.750

Mitchell Ginsberg: Your retail was the next sector that was affected but, but not all once and not all retail is created equal, so you know for tenant makes.

171

00:24:22.170 –> 00:24:33.390

Mitchell Ginsberg: were relatively unaffected by covert and by shutdowns and social distancing etc, and you know so, for example, your your one tenant was a fedex store and.

172

00:24:34.590 –> 00:24:41.190

Mitchell Ginsberg: You know the other tenant was a grocery ankle whatever or home depot you know those those were doing great.

173

00:24:42.360 –> 00:24:46.020

Mitchell Ginsberg: you’re at your your strip centers are just had a lot of.

174

00:24:47.640 –> 00:24:57.990

Mitchell Ginsberg: restaurants and that kind of stuff have have struggled a bit so commercial lenders on on retail i’m going to really look at the tenants mix.

175

00:24:58.680 –> 00:25:15.480

Mitchell Ginsberg: In this environment and how affected have they been bought coven and what is the probability of survival, so I think that’s a that’s a almost a test that you guys can apply when looking at a at a particular commercial property is.

176

00:25:16.560 –> 00:25:26.070

Mitchell Ginsberg: What you know what is the tenants mix like and and How have they done and how they’re likely to do, and I think 14 I think all indicators, or were are on the.

177

00:25:26.640 –> 00:25:35.730

Mitchell Ginsberg: The tail end of this thing I think the latest numbers, or that they you know, giving vaccines to about a million people a day in the United States they’ve.

178

00:25:36.270 –> 00:25:42.540

Mitchell Ginsberg: vaccinated in excess of 70 million people and and, needless to say, probably the same amount have.

179

00:25:43.410 –> 00:25:51.900

Mitchell Ginsberg: contracted covert so you’ve got a large percentage of the population that shouldn’t have some level of immunity already possibly up to about 50%.

180

00:25:52.470 –> 00:26:00.090

Mitchell Ginsberg: So I think we’re getting to the tail end, you know we got a few more months, and I think that’s checked, so will will will be gone.

181

00:26:00.630 –> 00:26:11.610

Mitchell Ginsberg: there’s an enormous amount of stimulus money coming into the economy which, which obviously is is fueling economic activities so so that’s very positive I think there’s a lot of.

182

00:26:12.180 –> 00:26:23.910

Mitchell Ginsberg: pent up demand multifamily is going absolutely crazy, particularly in Arizona the prices are rising dramatically, as you guys would i’m sure, well, it is those of you that are in the.

183

00:26:24.750 –> 00:26:37.050

Mitchell Ginsberg: The single family home or the residential space i’ve seen that there’s certainly not an abundance of inventory out there on on on residential and the same goes for multi family.

184

00:26:37.950 –> 00:26:46.950

Mitchell Ginsberg: office I think is very similar to retail it’s going to be very much based on the tenants mix and how affected, they have been up pull now.

185

00:26:47.400 –> 00:26:57.630

Mitchell Ginsberg: But once again, I think I think you know everything that was a reality for the last year is going to start changing over the next few months, as this pandemic lifts and.

186

00:26:58.560 –> 00:27:07.230

Mitchell Ginsberg: And we can start getting back to normal that the negative I think of all this money that’s being you know trillions and trillions of dollars that.

187

00:27:08.460 –> 00:27:10.770

Mitchell Ginsberg: The the legislators are.

188

00:27:12.600 –> 00:27:15.900

Mitchell Ginsberg: pouring into the economy and essentially printing money.

189

00:27:17.400 –> 00:27:24.510

Mitchell Ginsberg: It is a danger for inflation and as a result upward pressure on interest rates, interest rates have bumped a little bit and then they’ve.

190

00:27:24.960 –> 00:27:32.970

Mitchell Ginsberg: They sort of come down a bit, but I think of anything that could be a concern because, even at the minute inflation’s thoughts.

191

00:27:33.450 –> 00:27:42.060

Mitchell Ginsberg: rearing its head the Fed has to react by starting to tide and money supply to to keep inflation and check, you know there hasn’t happened yet, I think.

192

00:27:42.630 –> 00:27:51.180

Mitchell Ginsberg: there’s there’s still you know enough recovery, so I think for the foreseeable future it’s unlikely that rates are going to go up dramatically but.

193

00:27:53.280 –> 00:27:53.790

Mitchell Ginsberg: I think.

194

00:27:55.020 –> 00:28:14.190

Mitchell Ginsberg: You know that that is a definite dangerous, I think, particularly in Arizona, you know you got positive population growth of in excess of 100,000 people a year that was the last number it’s probably even more you have all these major companies moving to the valley.

195

00:28:16.290 –> 00:28:24.960

Mitchell Ginsberg: From from California and other parts of the country, so I think I think Arizona the prognosis for commercial real estate, certainly for the.

196

00:28:25.530 –> 00:28:38.220

Mitchell Ginsberg: foreseeable 12 to 24 months is really good I think there’s there’s a lot of opportunity there’s there’s gonna be a lot of activity, and I think it’s it’s really a good time to be in this market.

197

00:28:39.480 –> 00:28:43.440

Mitchell Ginsberg: Any any questions on that guys anybody got anything.

198

00:28:44.340 –> 00:28:52.710

Tarja Panfil: what’s what are examples of your most popular loan products, right now, like the terms and interest rate, what did for investment properties.

199

00:28:53.220 –> 00:29:01.980

Mitchell Ginsberg: So savvy typically your multifamily is probably the hottest item at the moment, everybody everybody wants it, because it’s.

200

00:29:03.060 –> 00:29:09.000

Mitchell Ginsberg: You know, it seems to have done the work the best through all of this and there’s an enormous demand for housing.

201

00:29:10.170 –> 00:29:12.300

Mitchell Ginsberg: So occupancy levels are very high.

202

00:29:14.460 –> 00:29:28.980

Mitchell Ginsberg: So the, so I think I think in all intensive purposes that’s probably been the most popular in interest rates, you know, depending on the loan size if it’s a large what we call conforming agency, you know that’s still being in the APP or tues.

203

00:29:30.630 –> 00:29:39.060

Mitchell Ginsberg: But typically your interest rates are going to be in the mid threes at the moment on a typical intermediate adjustable and by intermediate adjustable.

204

00:29:40.980 –> 00:29:52.230

Mitchell Ginsberg: You you have like a fixed period could be five 710 years and then you have an amortization period, which could either be 2025 30 years.

205

00:29:52.590 –> 00:30:04.920

Mitchell Ginsberg: And then you have a maturity to which is, could you know be any way 510 15 years so So those are the most popular it could be like a typical loan product would be a what we call a 530 10.

206

00:30:04.980 –> 00:30:06.300

Adna Kozlica: What that means is your rates.

207

00:30:06.600 –> 00:30:07.860

Mitchell Ginsberg: For five years.

208

00:30:09.210 –> 00:30:09.540

Mitchell Ginsberg: It.

209

00:30:11.130 –> 00:30:26.460

Mitchell Ginsberg: It has a 30 year amortization and then matures in 10 years, which will mean it will readjust halfway through the loan, you know after five years, based on an index so typically those are the most popular loan products.

210

00:30:28.140 –> 00:30:36.690

Mitchell Ginsberg: But once again, the beauty of calm loan is we really don’t have a dog in the fight, as I say, I mean we are the marketplace so.

211

00:30:37.290 –> 00:30:53.130

Mitchell Ginsberg: You know, whatever any bank or credit union or debt fund or Fannie Mae or Freddie Mac land or cms land is offering we’re going to offer and ended ebbs and flows, you know, sometimes agency will be better on a particular transaction.

212

00:30:54.570 –> 00:30:55.230

Mitchell Ginsberg: Then.

213

00:30:56.520 –> 00:31:04.710

Mitchell Ginsberg: bang, you know the credit unions or phenomenal on some products because typically they don’t charge a prepayment penalty.

214

00:31:06.150 –> 00:31:17.820

Mitchell Ginsberg: So it just varies it’s going to vary product by product property by property, but the beauty of the platform is we’re going to get the bar the best that’s available out there just by virtue of technology.

215

00:31:19.110 –> 00:31:19.590

Jill Falconer: I meant.

216

00:31:20.190 –> 00:31:20.550

Mitchell Ginsberg: Yes.

217

00:31:20.820 –> 00:31:27.300

Jill Falconer: We have a question loans for apartments can they be obtained purchase and reposition financing.

218

00:31:27.990 –> 00:31:33.330

Mitchell Ginsberg: Absolutely apartments absolute yeah we got purchased we got rehab we do a lot of rehab.

219

00:31:33.900 –> 00:31:47.160

Mitchell Ginsberg: And anything from the library area which is you know seven $8,000 a door, all the way up to heavy rehab which could be like $30,000 a door we do it all, so the way that that would work is you do an initial bridge loan.

220

00:31:47.670 –> 00:31:57.390

Mitchell Ginsberg: For the rehab portion which typically is one to two years interest only and then that goes into rolls into permanent loan once the property stabilized.

221

00:31:58.440 –> 00:31:59.850

Jill Falconer: And also, what are you.

222

00:32:01.260 –> 00:32:02.460

Mitchell Ginsberg: So we.

223

00:32:03.870 –> 00:32:15.000

Mitchell Ginsberg: Generally charging it at various we have a sliding scale, but on a on a typical smaller deal and that we consider a million dollar to be a small deal we charge a point, but the beauty is.

224

00:32:16.080 –> 00:32:23.610

Mitchell Ginsberg: The banks don’t charge anything through our platform so typically if you would have gone to the bank directly, you would have paid a point or the borrower would have paid a point.

225

00:32:24.690 –> 00:32:38.610

Mitchell Ginsberg: But they discount their back to us, because we do all the initial sizing of the loan we package, the loan our packages are phenomenal we pull in market data we pulling comps here, the images of the property we do run all the spreads.

226

00:32:40.530 –> 00:32:48.540

Mitchell Ginsberg: So literally they can take our package and put it in front of a credit committee, so the lead does love our packages, and you know so i’m going to give you a real.

227

00:32:49.590 –> 00:32:50.940

Mitchell Ginsberg: Probably the ultimate.

228

00:32:52.230 –> 00:32:59.400

Mitchell Ginsberg: borrower experience, so it was a gentleman that he’s actually the President of our company now.

229

00:33:00.570 –> 00:33:07.980

Mitchell Ginsberg: He was he had exited out of a technology company and was buying some commercial real estate is buying an office building.

230

00:33:09.240 –> 00:33:10.530

Mitchell Ginsberg: Here in the valley.

231

00:33:12.330 –> 00:33:22.080

Mitchell Ginsberg: was intrigued by our platform, because he had been he technology, had it had a very deep banking relationship with a local bank and.

232

00:33:23.340 –> 00:33:27.750

Mitchell Ginsberg: But was intrigued by technology, so I said, even though your bank my banks on your system.

233

00:33:28.290 –> 00:33:41.640

Mitchell Ginsberg: I will go ahead and use you guys are finding exclusive and even if we go with my bank you guys in the mix so his bank obviously never charged him anything because you know that that we were we were going to make afi.

234

00:33:42.870 –> 00:33:49.020

Mitchell Ginsberg: For long and the short of it is because they really wanted to maintain his relationship and there was a lot of.

235

00:33:49.590 –> 00:34:06.360

Mitchell Ginsberg: Competition, for a very strong property in a very strong borrower we ended up getting him 50 basis points cheaper than his own Bank was originally offering him he became such a believer he invested in the company and then recently joined us about a year ago.

236

00:34:07.590 –> 00:34:18.600

Mitchell Ginsberg: To as as Presidents of the companies, so you know it’s it doesn’t cost the borrower Dom more, but the nature of the technology and the.

237

00:34:19.080 –> 00:34:28.980

Mitchell Ginsberg: Competition that it creates and the fact that the banks know that we control the transaction ensures that nothing’s left on the table the bar is going to get the best possible deal.

238

00:34:32.040 –> 00:34:41.340

Tarja Panfil: So go over the process, so we have a client who needs a wall, what do we do we give the phone number to Eric Oh, how do we, you know, can you.

239

00:34:42.060 –> 00:34:44.760

Mitchell Ginsberg: So the simplest way of doing it is.

240

00:34:46.590 –> 00:34:55.920

Mitchell Ginsberg: The borrower or you guys could just go to our website, which is COM pretty simple co m m a n.com.

241

00:34:57.150 –> 00:35:08.610

Mitchell Ginsberg: And then they just click on get a quote button and they fill in a very, very short simple application form and maybe Eric can actually walk you guys through that.

242

00:35:09.630 –> 00:35:16.020

Mitchell Ginsberg: And then, and then they’ll get a call from a lung consultant literally you know, in a very short time within an hour or so.

243

00:35:16.530 –> 00:35:30.360

Mitchell Ginsberg: And the loan consultant will walk him through the you know what they need, and they they loan options, and it should the pre QUAL and pretty much all day hand through the process Eric do you want to maybe bring that up on the system.

244

00:35:34.200 –> 00:35:37.110

Tarja Panfil: If you can let us know okay So then, then what happens.

245

00:35:37.200 –> 00:35:50.520

Mitchell Ginsberg: Alright, so so okay so once they get a pre QUAL they can go each party will get a portal that they can download the prequel certificate, they can sign a broker agreement right in the portal.

246

00:35:52.350 –> 00:36:11.310

Mitchell Ginsberg: The falling gets transferred to a transaction manager who’s allocated to the file and that’s a lucky equivalent to loan processor, they gather up the bottle then gets a needs list from the transaction manager get us your tax returns that are your personal financial and then the.

247

00:36:12.540 –> 00:36:15.330

Mitchell Ginsberg: Once ibarra uploads the needs list through the portal.

248

00:36:16.350 –> 00:36:23.160

Mitchell Ginsberg: The transaction manager will package, the loan and submit the loan to the six or so lenders that they working with.

249

00:36:23.940 –> 00:36:33.960

Mitchell Ginsberg: Generally within about a week we get term sheets back from all the lenders the transaction manager will then prepare a grid that they share with the borrowing goes through the benefits.

250

00:36:34.770 –> 00:36:45.510

Mitchell Ginsberg: of each Linda and of each term sheet the borrower all then select a term sheet that they want to work with and the lender that they want to work with.

251

00:36:46.230 –> 00:36:57.540

Mitchell Ginsberg: And they will sign the term sheet for their particular lender at that point that’s when is the only time is out of pocket costs for the borrower they paying the lender directly.

252

00:36:58.050 –> 00:37:10.770

Mitchell Ginsberg: For the third parties for appraisal, etc, we will then the whole the borrower’s hand throughout the process, working with a lender through the third parties and final end writing and drawing loan docs until funding.

253

00:37:11.820 –> 00:37:17.550

Mitchell Ginsberg: Typically, from start to end a typical commercial loan takes about 60 days to close.

254

00:37:18.840 –> 00:37:24.870

Mitchell Ginsberg: That typical we can close loans, a lot quicker, but it obviously limit some of the lenders, we can work with.

255

00:37:25.890 –> 00:37:44.010

Mitchell Ginsberg: or it could take a lot longer if you’re doing a had multifamily loan, we got one in our system it’s taking almost a year to close this just because you’re dealing with had but you know it’s just going to vary, but typically it’s about 60 days from beginning to end on a typical transaction.

256

00:37:44.430 –> 00:37:52.350

Tarja Panfil: about the financing, maybe you get the approval so for a contracts, the financing contingency 45 days 60 days.

257

00:37:52.620 –> 00:37:55.470

Mitchell Ginsberg: yeah I mean you’re going to get you’re gonna get a term sheet.

258

00:37:56.970 –> 00:38:04.650

Mitchell Ginsberg: So generally within within a you know, probably from the town of Oregon their documentation that you’re going to get a term sheet within.

259

00:38:05.400 –> 00:38:26.370

Mitchell Ginsberg: term sheets within a week and then you know from their point on, you know you it’s it’s a case of the borrower assigning the term sheet then typically most lenders from their point on are going to take about 45 days to actually give a proper sign off, but I think, with a term sheet.

260

00:38:28.530 –> 00:38:30.870

Mitchell Ginsberg: With you know four or five or six term sheets.

261

00:38:32.820 –> 00:38:45.000

Mitchell Ginsberg: So yeah typically Eric and correct me if i’m wrong, you know most contracts, we see our 3030 you know 30 day initial due diligence and in 30 days to close, is that typically what you seeing Eric.

262

00:38:45.660 –> 00:38:51.960

Eric Little: yeah that is pretty typical Mitch, we need at least 60 days you know you just got a lot of banks with the.

263

00:38:52.500 –> 00:39:06.870

Eric Little: paycheck protection program and things they’ve been dealing with with kovats so it’s a little bit slower, I mean I don’t think that was too far off even pre coven you don’t want to put a purchase agreement with 60 day runway and we see a lot of buyers now.

264

00:39:08.010 –> 00:39:17.370

Eric Little: Just asking for an additional 15 days you know addendum or extension put in put in their agreement should they need to exercise that option, because the bank.

265

00:39:17.970 –> 00:39:35.460

Eric Little: You know, was running slow or something like that we’ve seen that, before I mean We work very quickly on our end but we can’t control, you know, obviously, how quickly the credit committees take to get us terms back and so on and so forth, but 60 days I think is ample ample time.

266

00:39:40.230 –> 00:39:41.910

Mitchell Ginsberg: Any other questions guys.

267

00:39:42.630 –> 00:39:50.430

Tarja Panfil: Somebody has a question in the chat that that it was it you kind of address it, but if you can again say what is the following interest rate.

268

00:39:51.510 –> 00:39:53.760

Mitchell Ginsberg: Sorry, what is the current interest rate.

269

00:39:53.970 –> 00:39:56.040

Tarja Panfil: Oh interest rate I know.

270

00:39:59.220 –> 00:40:01.170

Mitchell Ginsberg: it’s a bit of a loaded question because.

271

00:40:01.200 –> 00:40:12.630

Mitchell Ginsberg: It could range from the the aptitude to 12% you know it just really dependent on the product, I mean this isn’t like residential way.

272

00:40:13.260 –> 00:40:20.040

Mitchell Ginsberg: You know this is Fannie Mae or Freddie mac’s rates and every lane is going to be the same, you know within a four quarter percent.

273

00:40:20.880 –> 00:40:29.220

Mitchell Ginsberg: Literally you know you’re you’re conforming or conventional agency multifamily could be in the aptitudes.

274

00:40:30.030 –> 00:40:42.270

Mitchell Ginsberg: Then you get a typically most bank deals are in the mid threes to four depending on the property type and it’s all going to vary on property type and loan to value and and how long is the term.

275

00:40:42.750 –> 00:40:52.050

Mitchell Ginsberg: You know, is it a five year is it a seven year is that a tenure, you know five years typically going to be in the mid threes 10 years could be in the early fours.

276

00:40:52.500 –> 00:41:01.770

Mitchell Ginsberg: Then you can get into rehab loans rehab loans are typically going to be maybe in the five to 6% interest range and then you get up into the private many.

277

00:41:02.700 –> 00:41:11.700

Mitchell Ginsberg: range, which is you know for a quick close if somebody needs to close in something very quickly it’s a non performing property is not generating any kind of cash flow.

278

00:41:13.050 –> 00:41:31.440

Mitchell Ginsberg: And that could range anywhere from eight to 12% so that’s typically so yeah it’s you know, on commercial is very much predicated on the type of loan and the property type and the size of law which is going to dictate your interest rate.

279

00:41:31.890 –> 00:41:33.960

Tarja Panfil: So you actually do hard money loans to.

280

00:41:34.320 –> 00:41:35.610

Mitchell Ginsberg: yeah absolutely.

281

00:41:36.750 –> 00:41:40.980

Jill Falconer: We also had another question about what is your typical volume of lines per year.

282

00:41:42.120 –> 00:41:48.450

Mitchell Ginsberg: So we currently getting in probably at the moment about 300 loans, a month.

283

00:41:50.400 –> 00:42:01.560

Mitchell Ginsberg: So you know if you bet put that on the annual basis would be about 3600 but we’re ramping that up, I mean we’re we’re expecting it to be almost three times that by the end of the year.

284

00:42:02.790 –> 00:42:05.820

Mitchell Ginsberg: we’re we’re growing dramatically, I mean we’re.

285

00:42:06.930 –> 00:42:14.070

Mitchell Ginsberg: Typically, adding probably this month we’re adding probably about three new staff members so even with the technology.

286

00:42:15.450 –> 00:42:21.570

Mitchell Ginsberg: We were growing dramatically we doing a lot of online marketing.

287

00:42:23.280 –> 00:42:32.190

Mitchell Ginsberg: And we have a lot of you know, different strategic relationships with different companies we’ve just integrated with brevity, which is that online listing platform.

288

00:42:32.790 –> 00:42:41.940

Mitchell Ginsberg: it’s it’s in the beta stage that’s a limited number of properties in limited states, but what happens anybody goes on the bravest test site and looks at a particular property.

289

00:42:43.320 –> 00:42:50.670

Mitchell Ginsberg: automatically there’s going to be alone quote from calm loan on the site and it’s our technology that integrated with theirs.

290

00:42:52.740 –> 00:42:55.560

Mitchell Ginsberg: So yeah we’re we’re growing.

291

00:42:57.330 –> 00:42:59.160

Jill Falconer: what’s the most popular discipline.

292

00:43:01.080 –> 00:43:03.960

Mitchell Ginsberg: Discipline What do you mean by discipline.

293

00:43:04.170 –> 00:43:05.250

Jill Falconer: i’m not sure.

294

00:43:05.490 –> 00:43:09.510

Eric Little: You mean asset type like property type that we focus on or.

295

00:43:09.690 –> 00:43:10.500

Jill Falconer: yeah I guess.

296

00:43:11.160 –> 00:43:15.150

Eric Little: yeah well we, you know as a marketplace, of course, you know we can’t.

297

00:43:16.080 –> 00:43:26.550

Eric Little: pick and choose you know, like Mitch said we’ve focused on office retail industrial apartments but of those four in the in the four major food groups, if you will i’d say it’s a.

298

00:43:27.030 –> 00:43:45.720

Eric Little: it’s a pretty high percentage multifamily you know five plus units constitutes a commercial asset if it’s less than four units it’s back in residential guidelines, so we we tend to thrive on on the multifamily apartments space.

299

00:43:51.210 –> 00:43:59.670

Jill Falconer: And there’s a question in the chat do you foresee ground up construction or land loans as a possibility, in the future.

300

00:44:00.210 –> 00:44:08.460

Mitchell Ginsberg: yeah I think definitely in the future and and and you know, like any technology platform Amazon started off selling books.

301

00:44:09.540 –> 00:44:22.980

Mitchell Ginsberg: you’ve got to pick a narrow vertical and get really good at it before you want to start adding other verticals you know the technological technology requirements for managing construction.

302

00:44:23.820 –> 00:44:31.050

Mitchell Ginsberg: You know it’s going to be a lot more complicated, then you know even rehab because rehab pretty much.

303

00:44:31.740 –> 00:44:36.540

Mitchell Ginsberg: From our perspective, it works, the same as a permanent loan we pretty much find on and it’s done.

304

00:44:37.050 –> 00:44:45.990

Mitchell Ginsberg: So I think construction is a lot more moving parts, so you know we we’ve chosen to stay out of it for the foreseeable future and land also it’s just it’s just.

305

00:44:46.920 –> 00:45:06.810

Mitchell Ginsberg: it’s the guidelines on very clear on underwriting land it’s more just got and we don’t go by guy that’s got to be very defined variables that can be put into search engine, so you know i’d say at some point down the line years but probably for the foreseeable future now.

306

00:45:07.710 –> 00:45:13.440

Tarja Panfil: You have any lender said, we know that our lending Poland, they.

307

00:45:15.090 –> 00:45:28.890

Mitchell Ginsberg: say you know it’s yeah I mean we don’t we haven’t really even try, you know aws, but I think typically a lot of the smaller Community banks within their area with a land is are going to be, you know.

308

00:45:30.000 –> 00:45:40.800

Mitchell Ginsberg: Good alternatives for land, because you know that’s you know typically those banks can go drive by and they’ve known as a loan officer drives by the land on the way to work kind of thing and it’s.

309

00:45:41.850 –> 00:45:57.930

Mitchell Ginsberg: A very familiar and they know what for cross the road and what’s going up two streets down and the top two things so but yeah I would typically say it’s very localized with your local community banks credit unions, would be the best for for land deals.

310

00:46:01.440 –> 00:46:03.120

Mitchell Ginsberg: In any other questions guys.

311

00:46:06.360 –> 00:46:08.250

Mitchell Ginsberg: Okay, great well I guess.

312

00:46:10.020 –> 00:46:12.150

Mitchell Ginsberg: just finished this a few minutes early but.

313

00:46:13.560 –> 00:46:19.650

Mitchell Ginsberg: nobody’s got any other questions really appreciate the time and certainly love the opportunity of working with you guys.

314

00:46:21.840 –> 00:46:29.130

Mitchell Ginsberg: And you know just growing your commercial division from strength to strength using our technology.

315

00:46:30.300 –> 00:46:32.160

Tarja Panfil: Thank you so much Eric.

316

00:46:32.790 –> 00:46:35.850

Mitchell Ginsberg: Alright, thanks guys appreciate it, thank you.

317

00:46:36.060 –> 00:46:37.560

Eric Little: bye bye Thank you Thank you guys.